Quality at the right price.

Everyone should have access to cost-efficient, high-quality investment tools.

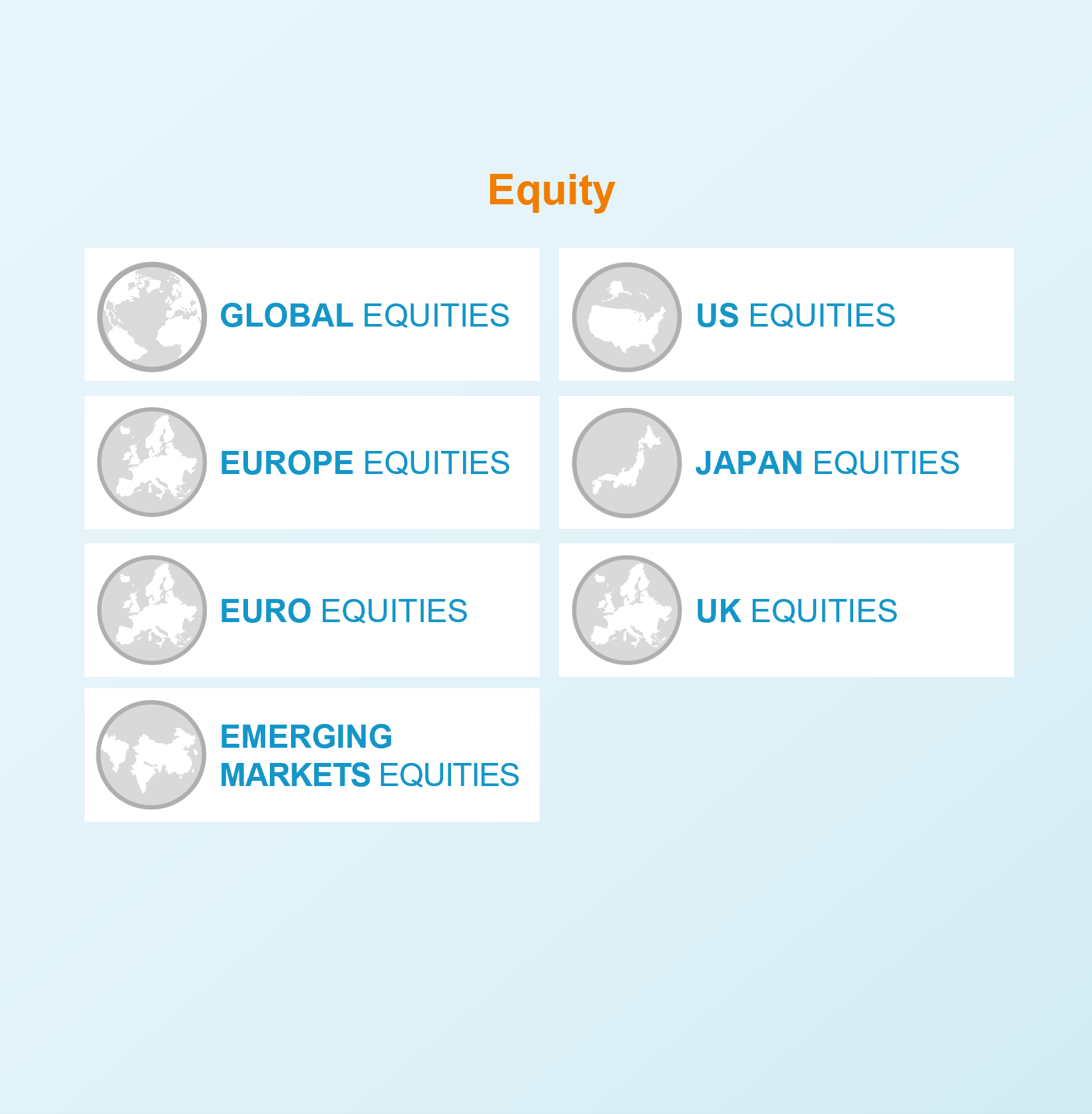

Our Prime ETF range provides you with low-cost access to the must-have building blocks for any diversified portfolio. Spanning equity and fixed income, our Prime ETFs cover the main geographies with fees from just 0.05%*.

* Management fees refer to the management fees and other administrative or operating costs of the fund. For more information regarding all the costs supported by the fund, please refer to its Key Information Document (KID). Transaction cost and commissions may occur when trading ETFs.

Clear and simple.

In order to offer you a range of building blocks with such low fees, we partnered with Solactive, a leading index provider with over 10 years’ experience.

Combining their high quality indices with our expertise and bargaining power as the largest European ETF provider, we created a range of simple, transparent and physically-replicated funds across the core asset classes and geographies.

Amundi Prime ETFs make building low-cost portfolios easy.

13

ETFs

€ 4bn+

in AUM

Ultra-low cost

with management fees* starting at 0.05%

Source: Amundi ETF, data as of 29/02//2024. Given for indicative purposes only, may change without prior notice.

*Management fees refer to the management fees and other administrative or operating costs of the fund. For more information regarding all the costs supported by the fund, please refer to its Key Information Document (KID). Transaction cost and commissions may occur when trading ETFs.or